Is Business Interruption Insurance Worth It?

2/2/2021 (Permalink)

4 Types of Losses That Business Interruption Insurance Covers

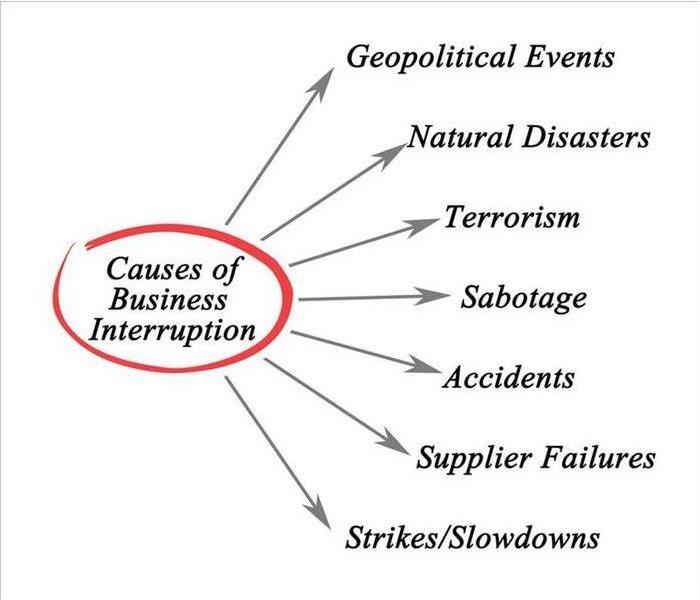

Choosing insurance can be a confusing and time-consuming process, weighing affordability against necessity. When it comes to protecting your business, interruption insurance may be overlooked, yet it can be a business-saver in the event of a disaster. Your business could be out of service for a month or more for restoration purposes. Property insurance covers physical assets, but what doesn’t it cover? Here are four types of losses that business interruption insurance covers that property insurance doesn’t:

1. Lost Profits

If your business is unable to run properly, time out of service will mean profit loss. Typically the insurance company will assess recent profits and reimburse the expected loss amount.

2. Lost Employee Wages

Employees can’t be without work for long without wages. More than a few weeks without a paycheck could be a deal-breaker for employees living paycheck to paycheck. Interruption insurance eases the pain by covering employees’ wages until payroll resumes.

3. Temporary Operating Location

Especially in the event of a fire, the building might be so damaged that you can’t work out of that location. Fire restoration experts will probably be required to get your business up and running again as soon as possible. A temporary location could be necessary to keep your business afloat. Business interruption insurance can cover relocation and operation costs.

4. Lease and Loans

Monthly lease and loan payments will continue to come due. This insurance might cover some of those costs (e.g., building and machinery). Eviction or repossession is a real possibility if a payment is more than a couple of months late so having this kind of coverage could be critical to the survival of your business.

As a business owner in Rest Haven, GA, you need the assurance that your enterprise will survive the worst calamity. You’ll want to weigh the cost of the interruption insurance against what you can afford and what you can’t afford to lose. Creating a plan for a potential disaster can diminish worries before and after a catastrophic event. This will allow you to concentrate on keeping your company financially secure until your business can be restored.

24/7 Emergency Service

24/7 Emergency Service